Home insurance premiums in Florida are a significant concern for homeowners, fluctuating wildly based on a complex interplay of factors. This guide delves into the intricacies of Florida’s home insurance market, exploring the key elements that determine your premium, from location and property features to insurance company practices and the impact of natural disasters. Understanding these factors empowers you to make informed decisions and potentially save money on your insurance.

We’ll examine how hurricane risk, property characteristics, and your claims history all contribute to the final cost. We’ll also compare different insurance providers, their coverage options, and the available discounts, ultimately equipping you with the knowledge to navigate the complexities of Florida’s unique insurance landscape.

Factors Influencing Home Insurance Premiums in Florida

Florida’s home insurance market is unique due to its vulnerability to hurricanes and other natural disasters. Several factors significantly impact the cost of premiums, making it crucial for homeowners to understand these elements to secure the best possible coverage at a reasonable price.

Location’s Impact on Home Insurance Costs

Your home’s location is a primary determinant of your insurance premium. Proximity to the coast and placement within designated hurricane zones dramatically influence risk assessment. Homes in coastal areas, particularly those in high-risk hurricane zones, face substantially higher premiums due to the increased likelihood of hurricane damage. Conversely, homes located further inland and in lower-risk zones typically enjoy lower premiums.

Insurance companies use sophisticated models incorporating historical hurricane data, projected storm paths, and flood maps to calculate this risk. For example, a home in a high-risk zone in Miami-Dade County will likely pay significantly more than a similar home in a low-risk zone in central Florida.

Influence of Home Features on Premiums

The characteristics of your home itself play a vital role in determining your premium. Older homes, generally, command higher premiums than newer ones due to potential deterioration and outdated building codes. Construction materials also matter; homes built with impact-resistant roofing and reinforced concrete are typically considered less risky and may attract lower premiums. The type of roof is crucial; a newer, impact-resistant roof will lower your premium compared to an older, less durable roof.

For instance, a home built in the 1950s with a standard asphalt shingle roof will likely have a higher premium than a newer home built with a reinforced concrete roof and impact-resistant windows.

Insurance Premiums for Different Home Types

Insurance premiums vary significantly depending on the type of home. Single-family homes, due to their size and potential for greater damage, often carry higher premiums than condominiums or townhouses. Condominiums typically have lower premiums because the building’s exterior and common areas are covered by the homeowner’s association’s insurance. Townhouses fall somewhere in between, depending on the building’s construction and the level of shared responsibility for maintenance.

The differences in coverage and risk assessment contribute to these varying premium costs.

Claims History’s Effect on Future Premiums

Your claims history significantly impacts future premiums. Filing multiple claims, especially for significant events, can lead to higher premiums in subsequent years. Insurance companies view frequent claims as an indicator of higher risk, justifying an increase in premiums to offset potential future losses. Conversely, maintaining a clean claims history can lead to discounts and lower premiums over time.

For example, filing a claim for minor wind damage might not drastically affect premiums, but filing multiple claims for water damage or hurricane-related damage will likely result in substantial premium increases.

Average Premiums Across Florida Counties

The following table provides a simplified comparison of average home insurance premiums across several Florida counties. Note that these are averages and actual premiums will vary based on individual factors.

| County | Average Premium | Hurricane Zone | Average Home Value |

|---|---|---|---|

| Miami-Dade | $3,500 | High | $450,000 |

| Broward | $2,800 | High | $400,000 |

| Palm Beach | $2,500 | High | $375,000 |

| Orange | $1,800 | Moderate | $300,000 |

Insurance Company Practices and Policies

Shopping for home insurance in Florida can feel like navigating a maze, with premiums varying significantly between providers. Understanding the practices and policies of different insurance companies is crucial to securing the best coverage at a reasonable price. This section will explore the key factors that influence these variations.

Variations in Premium Pricing

Insurance companies in Florida use different models to assess risk and calculate premiums. Factors like the age and condition of your home, its location (including proximity to hurricane-prone areas and flood zones), and your claims history all play a significant role. However, even with similar risk profiles, premiums can vary substantially between insurers. This is due to a combination of factors, including the company’s internal risk assessment methodologies, their financial stability, the types of coverage they prioritize, and their overall business strategy.

Some insurers may focus on attracting lower-risk clients, leading to lower premiums for those who qualify. Others might offer broader coverage but at a higher price point.

The Role of Discounts

Many Florida home insurers offer discounts to incentivize policyholders to take steps to mitigate risk. These discounts can significantly reduce premiums. Common examples include discounts for installing security systems (like burglar alarms and security cameras), having smoke detectors, impact-resistant windows and doors, and purchasing multiple policies (like bundling home and auto insurance) from the same company. Some insurers also offer discounts for claims-free periods or for completing home safety courses.

The availability and amount of these discounts vary widely depending on the insurer and the specific measures taken.

Coverage Options and Policy Differences

Insurers in Florida offer various coverage options, each with its own set of deductibles and policy limits. Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Policy limits define the maximum amount the insurer will pay for a covered loss. Some insurers offer broader coverage, including additional living expenses in the event of damage rendering your home uninhabitable.

Others might focus on more basic coverage, leading to lower premiums but potentially higher out-of-pocket costs in the event of a significant claim. Understanding these differences is vital in selecting a policy that meets your specific needs and financial capabilities.

Common Exclusions and Limitations

It’s important to be aware of common exclusions and limitations in Florida home insurance policies. While most policies cover damage from windstorms and hurricanes (though often with specific deductibles and exclusions for flooding), some insurers might place restrictions on coverage for specific types of damage, such as damage caused by gradual wear and tear, insects, or flooding from a non-covered source.

Furthermore, some policies may have specific limitations on the amount they’ll pay for certain types of repairs or replacements. Carefully reviewing the policy documents is essential to understand what is and isn’t covered.

Comparison of Key Insurance Providers

| Insurer | Average Premium (Estimate) | Key Coverage Features | Discount Availability |

|---|---|---|---|

| State Farm | Varies significantly by location and risk profile; contact for quote | Windstorm, hurricane, fire, theft, liability; various optional add-ons | Bundling discounts, security system discounts, claims-free discounts |

| Citizens Property Insurance | Generally lower than private insurers, but may have stricter requirements | Basic windstorm, hurricane, fire, and other standard coverages | Limited discounts compared to private insurers |

| Universal Property & Casualty Insurance Company | Varies significantly by location and risk profile; contact for quote | Comprehensive coverage options, including various add-ons | Bundling discounts, security system discounts, claims-free discounts |

The Impact of Natural Disasters on Premiums

Florida’s susceptibility to hurricanes and other natural disasters significantly influences home insurance premiums. The frequency and intensity of these events directly impact the risk assessment made by insurance companies, leading to fluctuations in the cost of coverage. Understanding this relationship is crucial for both homeowners and insurers.

Hurricane Frequency and Severity

The correlation between hurricane activity and home insurance costs is undeniable. More frequent and intense hurricanes translate to higher payouts for insurance companies, forcing them to increase premiums to offset these losses. For example, the devastating 2004 and 2005 hurricane seasons led to a dramatic spike in premiums across the state, as insurers faced billions of dollars in claims.

Conversely, periods with fewer or weaker hurricanes can result in slightly lower premiums, although this effect is often tempered by other factors. The increased use of sophisticated meteorological models allows for more accurate prediction of hurricane intensity and path, which helps insurers better assess and price risk, though the inherent uncertainty remains.

Flood Insurance and its Impact

While most standard homeowners insurance policies donot* cover flood damage, flood insurance is a separate and crucial component of comprehensive risk management in Florida. Flood insurance premiums are determined by factors such as the property’s location within a designated flood zone, the elevation of the structure, and the value of the building and its contents. The cost of flood insurance can significantly increase a homeowner’s overall insurance expenses, particularly for properties situated in high-risk areas.

The National Flood Insurance Program (NFIP) is a key provider of flood insurance, and its rates are often influenced by federal regulations and reinsurance mechanisms. The cost of this additional insurance must be considered alongside the cost of standard homeowner’s insurance.

Government Regulations and Mitigation Efforts

Government regulations and mitigation efforts play a significant role in shaping insurance pricing. Building codes and regulations aimed at improving the resilience of structures to hurricanes (e.g., stronger roof requirements, impact-resistant windows) can lead to lower premiums for homes that meet these standards. Conversely, areas with lax building codes or limited mitigation measures may face higher premiums due to increased risk.

Government-sponsored initiatives such as the Florida Building Code and various community-level mitigation programs influence insurance rates by affecting the likelihood and severity of future damage. Insurers often reward homeowners who take steps to mitigate risk, reflecting the positive impact of preventative measures on overall insurance costs.

Insurer Risk Assessment Based on Data and Location

Insurance companies use sophisticated models to assess risk, drawing heavily on historical weather data and geographic location. They analyze historical hurricane tracks, wind speeds, rainfall amounts, and flood depths to determine the probability of damage in specific areas. Properties located in coastal zones or areas with a history of frequent flooding typically command higher premiums due to the increased likelihood of damage.

Insurers also consider factors such as the age and construction of the home, the presence of mitigation features, and the proximity to fire hydrants and fire stations. This comprehensive analysis enables insurers to create a more precise risk profile for each property and tailor premiums accordingly.

Preventative Measures to Lower Premiums

Homeowners can take several steps to reduce their insurance premiums. These measures demonstrate a commitment to risk mitigation and can lead to significant savings:

- Install impact-resistant windows and doors.

- Reinforce the roof to withstand high winds.

- Elevate the home to reduce flood risk.

- Install hurricane shutters or impact-resistant garage doors.

- Plant landscaping strategically to protect the house from wind damage.

- Improve drainage around the foundation to minimize water damage.

- Regularly maintain the home’s structure and systems.

Taking these preventative measures not only reduces the risk of damage but also signals to insurers a commitment to responsible homeownership, potentially leading to lower premiums.

Consumer Considerations and Actions

Navigating the complexities of Florida’s home insurance market requires proactive steps from homeowners. Understanding your options, carefully reviewing policies, and knowing how to file a claim are crucial for securing adequate coverage at a reasonable price. This section provides practical advice to empower consumers to make informed decisions about their home insurance.

Shopping for the Best Home Insurance Rates

Finding the best home insurance rate in Florida involves comparing quotes from multiple insurers. Don’t rely on just one company; shop around to see the range of prices and coverage options available. Consider factors like your home’s features, location, and coverage needs when comparing quotes. Online comparison tools can be helpful, but remember to verify the information independently.

It’s also wise to check the insurer’s financial stability rating to ensure they can pay out claims if needed.

Understanding Policy Terms and Conditions

Before purchasing a policy, thoroughly review the terms and conditions. Pay close attention to the coverage limits, deductibles, exclusions, and any specific conditions related to Florida’s unique risks, such as hurricanes and flooding. Don’t hesitate to ask questions if anything is unclear. A comprehensive understanding of your policy protects you from unexpected costs and disputes later. Consider consulting with an independent insurance agent to help you interpret complex policy language.

Filing a Claim and the Claims Process, Home insurance premiums in Florida

Filing a claim usually involves contacting your insurance company immediately after an incident. Provide detailed information about the damage, including photos and documentation if possible. Your insurer will then assign an adjuster to assess the damage and determine the amount of coverage. Be prepared for a thorough investigation, which may include inspections and appraisals. The claims process can take time, so patience and clear communication are key.

Keep records of all communication and documentation related to your claim.

Benefits of Working with an Independent Insurance Agent

Independent insurance agents represent multiple insurance companies, allowing them to offer a wider range of options and find the best fit for your specific needs and budget. They can provide unbiased advice, navigate complex policies, and assist with the claims process. Their expertise in the Florida insurance market is invaluable, especially given the state’s unique challenges. An independent agent can save you time and effort in finding the right coverage.

Comparing Home Insurance Quotes: A Step-by-Step Guide

Comparing quotes effectively requires a systematic approach. Here’s a step-by-step guide:

- Determine your coverage needs: Consider the value of your home, personal belongings, and liability concerns.

- Gather information: Collect details about your home, such as its age, size, and features.

- Obtain quotes from multiple insurers: Use online comparison tools or contact insurers directly.

- Compare quotes carefully: Pay close attention to coverage limits, deductibles, premiums, and any exclusions.

- Review policy documents: Thoroughly examine the terms and conditions of each policy before making a decision.

- Choose the best policy: Select the policy that offers the best balance of coverage, price, and financial stability of the insurer.

Illustrative Examples of Premium Variations

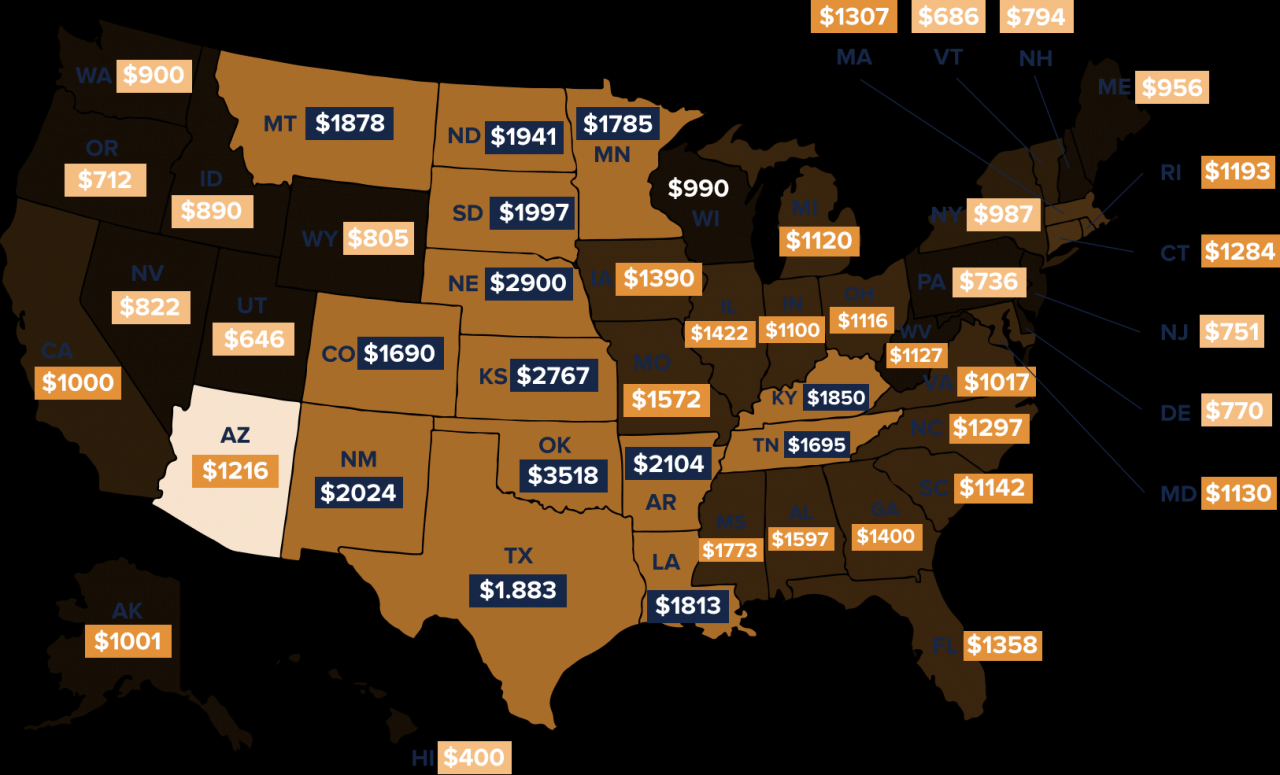

Source: weekendlandlords.com

Understanding how various factors influence home insurance premiums in Florida requires looking at concrete examples. The following scenarios illustrate the impact of location, coverage levels, and claim history on premium costs.

Premium Differences Based on Hurricane Risk Zone

Consider two identical homes: both are 2,000 square feet, single-family dwellings built in 2010, located in Florida. Home A is situated in a high-risk hurricane zone, specifically within a designated evacuation zone with a high probability of storm surge. Home B is located inland, in a low-risk zone with minimal hurricane exposure. Assuming similar coverage amounts and homeowner profiles, Home A’s premium would likely be significantly higher—perhaps double or even triple—that of Home B.

This difference reflects the increased risk the insurance company faces in covering potential hurricane damage in a high-risk area. The insurer’s actuarial models reflect historical claims data, showing a statistically higher likelihood of severe damage and payouts for homes in high-risk zones.

Premium Differences Based on Liability Limits

Let’s examine two policies for the same 2,000-square-foot home in a moderate-risk zone. Policy A offers $300,000 in liability coverage, while Policy B offers $1,000,000. All other aspects of the policies—dwelling coverage, personal property coverage, etc.—are identical. Policy B, with the higher liability limit, will have a higher premium than Policy A. This increase reflects the greater financial responsibility the insurance company undertakes with a higher liability limit.

If a lawsuit arises due to an accident on the property, the insurer’s potential payout is significantly higher under Policy B, thus justifying the premium difference. The difference in premium might range from a few hundred to a thousand dollars annually, depending on the insurer and other factors.

Premium Impact of a Previous Claim

Imagine a homeowner with a 1,500-square-foot home who filed a claim for water damage due to a plumbing leak three years ago. The claim resulted in a $5,000 payout from the insurance company. Even if the homeowner has had no other claims since, their premiums are likely to be higher than those of a homeowner with a clean claim history.

Insurance companies view past claims as indicators of potential future risks. The insurer may perceive a higher likelihood of future claims, potentially related to ongoing maintenance issues, leading them to increase the premium to offset the perceived elevated risk. The increase might range from 5% to 20% or more, depending on the insurer’s underwriting guidelines and the severity of the previous claim.

Epilogue

Securing affordable and comprehensive home insurance in Florida requires careful planning and research. By understanding the factors influencing premiums, comparing different insurers, and taking preventative measures, Florida homeowners can effectively manage their insurance costs and protect their most valuable asset. Remember to thoroughly review policy terms, shop around for the best rates, and consider working with an independent agent for personalized guidance.

Taking a proactive approach to your home insurance ensures peace of mind and financial security.

FAQ

What is the average cost of home insurance in Florida?

The average cost varies greatly depending on location, property type, and coverage. There’s no single answer, but expect significant differences between coastal and inland areas.

Can I get home insurance if I have a previous claim?

Yes, but your premiums will likely be higher. Insurers consider claims history when assessing risk.

What is the role of a public adjuster?

A public adjuster represents you in your insurance claim, negotiating with the insurer on your behalf. They charge a fee based on the claim settlement amount.

How often should I review my home insurance policy?

At least annually, or whenever there are significant changes to your property or risk factors (e.g., renovations, additions).

What does “wind mitigation” mean and how does it affect my premium?

Wind mitigation refers to upgrades to your home designed to reduce wind damage during a hurricane. These upgrades can qualify you for discounts on your premium.