Home insurance premiums in United Arab Emirates can vary significantly depending on several factors. Understanding these factors is crucial for securing the best and most affordable coverage for your property. This guide explores the key influences on home insurance costs in the UAE, including location, property type, coverage level, and individual risk profiles, offering insights into how these elements impact premiums across different emirates.

We’ll also compare major insurance providers, delve into policy exclusions, and provide tips for obtaining affordable home insurance.

From the bustling cityscapes of Dubai to the tranquil landscapes of Abu Dhabi, the cost of protecting your home in the UAE depends on a complex interplay of factors. This guide will dissect these factors, providing a clear understanding of what influences your premium and how you can make informed decisions to secure the best possible coverage at a competitive price.

We will cover everything from the type of building materials used to the potential impact of natural disasters, enabling you to navigate the UAE home insurance market with confidence.

Factors Influencing Home Insurance Premiums in the UAE

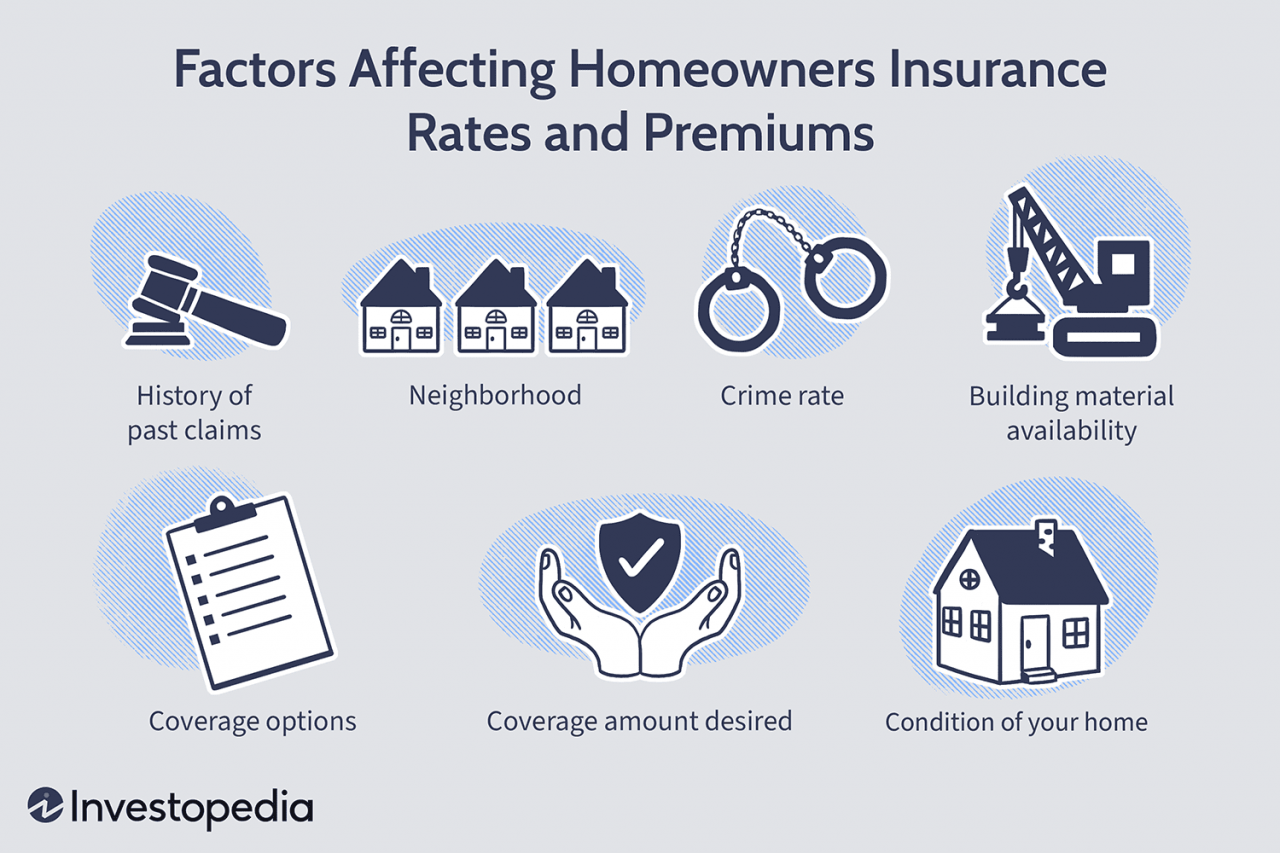

Home insurance premiums in the UAE, like anywhere else, aren’t a one-size-fits-all proposition. Several interconnected factors contribute to the final cost, making it crucial for homeowners to understand these elements to secure the best possible coverage at a competitive price. This section details the key factors influencing premium costs across different emirates.

Location of the Property

The location of your property significantly impacts your insurance premium. Areas with higher crime rates, a greater risk of natural disasters (like flooding in coastal regions), or a higher density of buildings generally attract higher premiums. For example, properties in areas prone to flooding in Dubai might see higher premiums compared to those situated inland in Abu Dhabi. This is because insurers assess the likelihood of claims based on historical data and geographical risk assessments.

Areas with robust infrastructure and lower risk profiles often benefit from lower premiums.

Type of Property

The type of property you own also plays a crucial role. A detached villa typically carries a lower risk profile than a high-rise apartment building, potentially resulting in lower premiums for the villa owner. This is due to factors like the construction materials, the building’s age, and the overall structural integrity. Older buildings may require more extensive maintenance and pose a higher risk of damage, leading to higher premiums.

The size of the property also influences the premium; larger properties generally have higher premiums.

Level of Coverage, Home insurance premiums in United Arab Emirates

The extent of coverage you choose directly affects your premium. Comprehensive coverage, encompassing a wider range of risks (e.g., fire, theft, flooding, liability), will naturally be more expensive than a basic policy covering only essential elements. Homeowners can customize their coverage to match their specific needs and budget, but opting for a higher level of coverage invariably leads to higher premiums.

This reflects the increased financial responsibility undertaken by the insurer.

Individual Risk Profile

Insurers also consider the homeowner’s risk profile when determining premiums. This includes factors such as the homeowner’s claims history (previous insurance claims), security measures in place (e.g., alarm systems, security guards), and the presence of any hazardous materials on the property. A homeowner with a history of claims may face higher premiums compared to one with a clean record.

Similarly, properties with robust security measures may qualify for discounts.

Comparative Impact Across Emirates

While the factors mentioned above apply across all emirates, their relative impact can vary. For instance, the risk of flooding might be a more significant factor in coastal emirates like Dubai and Sharjah compared to inland emirates like Abu Dhabi. Similarly, crime rates and property values can differ significantly between emirates, influencing the overall premium calculation. Generally, areas with higher property values tend to attract higher premiums.

Relative Impact of Factors on Premium Prices

| Factor | Impact (1-5) | Factor | Impact (1-5) |

|---|---|---|---|

| Location | 4 | Type of Property | 3 |

| Coverage Level | 5 | Individual Risk Profile | 4 |

Types of Home Insurance Coverage Available in the UAE

Choosing the right home insurance policy in the UAE depends on your individual needs and the level of protection you require. Several types of policies are available, each offering different levels of coverage and, consequently, different premium costs. Understanding these variations is crucial for making an informed decision.

Home insurance policies in the UAE typically fall into a few main categories, each offering a distinct range of protection. These categories aren’t mutually exclusive; some policies offer combinations of features. It’s important to carefully review the policy wording to understand exactly what is and isn’t covered.

Building and Contents Coverage

This is the most common type of home insurance in the UAE. It provides coverage for damage to the structure of your home (building) and the contents within it. Building coverage typically protects against damage from fire, floods, storms, and other specified perils. Contents coverage protects your personal belongings, such as furniture, electronics, and clothing, against similar risks. The policy usually specifies a sum insured for both the building and the contents, which determines the maximum payout in case of a claim.

Examples of clauses might include specific exclusions for damage caused by wear and tear, or pre-existing conditions. Exclusions could also relate to certain types of events, like earthquakes (unless specifically included as an add-on). The policy will also likely specify a deductible, meaning you’ll have to pay a certain amount before the insurance company covers the rest.

Liability Coverage

This type of coverage protects you against legal liability if someone is injured or their property is damaged on your property. For example, if a guest slips and falls, this coverage could help pay for their medical bills and any legal costs. The amount of liability coverage is usually a separate limit specified in the policy.

A common exclusion might be liability arising from intentional acts. Another example could be the exclusion of liability for damage caused by a tenant, if the property is rented out.

Loss of Rent Coverage

If your home becomes uninhabitable due to an insured event (like a fire), this coverage can help pay for temporary accommodation while repairs are underway. This usually covers the cost of renting a comparable property for a specified period.

A typical exclusion would be if the un-inhabitability is due to a lack of maintenance on your part, rather than an insured event. The policy will likely stipulate a maximum period for which loss of rent will be covered.

Optional Add-ons

Many insurers offer optional add-ons to enhance basic coverage. These could include coverage for specific perils (like earthquakes or floods), personal liability extensions, or valuable items coverage (for jewelry, artwork, etc.). These add-ons increase the premium but provide more comprehensive protection.

Examples of add-on clauses could include specific limitations on the value of covered jewelry or artwork, or requirements for additional security measures to be in place to qualify for certain coverage.

Comparison of Coverage and Premiums

The table below illustrates a simplified comparison. Actual premiums vary greatly depending on factors like location, property value, coverage limits, and individual risk profiles. This is for illustrative purposes only and should not be considered a definitive price guide.

| Policy Type | Coverage | Premium Range (AED per year – estimated) |

|---|---|---|

| Basic Building & Contents | Building structure and contents against fire, theft, etc. | 2,000 – 5,000 |

| Comprehensive Building & Contents | Includes broader perils, higher coverage limits. | 5,000 – 10,000 |

| Building & Contents + Liability | Adds liability coverage for accidents on your property. | 6,000 – 12,000 |

| Comprehensive with Add-ons (e.g., earthquake) | Most extensive coverage, including optional extras. | 10,000+ |

Comparing Home Insurance Providers in the UAE

Choosing the right home insurance provider in the UAE can be a daunting task, given the variety of options available. This section compares three major providers, highlighting their pricing, coverage, and customer service to help you make an informed decision. Remember that prices and specific coverage details can change, so it’s crucial to check directly with the provider for the most up-to-date information.

Major Home Insurance Providers in the UAE: A Comparison

Several insurance companies operate in the UAE, offering a range of home insurance policies. The following table compares three prominent providers, focusing on aspects crucial to consumers. Note that the average premium cost is an approximation and will vary significantly based on factors like property value, location, and coverage level. Customer review summaries are based on publicly available online reviews and should be considered a general overview.

| Provider Name | Average Premium Cost (AED) | Key Coverage Features | Customer Reviews Summary |

|---|---|---|---|

| AXA Insurance | Varies greatly; expect a range from 1,500 to 5,000+ depending on factors | Building and contents coverage, liability protection, optional add-ons for specific risks (e.g., flood, earthquake), 24/7 claims support | Generally positive reviews, praising efficient claims processing and responsive customer service. Some negative comments relate to occasional delays in communication. |

| Dubai Insurance Company (DIC) | Varies greatly; expect a range from 1,200 to 4,000+ depending on factors | Comprehensive coverage for buildings and contents, liability protection, options for additional coverage like loss of rent, various policy options for different needs | Mixed reviews. Positive feedback often focuses on competitive pricing. Negative comments sometimes mention difficulties in reaching customer service representatives. |

| Oman Insurance Company | Varies greatly; expect a range from 1,000 to 4,500+ depending on factors | Standard building and contents coverage, personal liability protection, options for additional coverage (e.g., jewelry, valuable items), online claims reporting | Reviews are generally positive, with many customers praising the ease of online claims submission and the clarity of policy information. Some complaints about claim settlement times have been noted. |

The Role of Building Materials and Construction in Premium Costs

Your home’s construction significantly impacts your home insurance premium in the UAE. Insurers assess the inherent risks associated with different building materials, construction techniques, and the overall condition of the property. Properties deemed more resistant to damage command lower premiums, while those considered more vulnerable attract higher costs.The type of building materials used plays a crucial role in determining risk.

For example, concrete structures are generally considered more durable and fire-resistant than those built primarily with wood. Modern construction methods, incorporating advanced techniques and materials, often lead to lower premiums compared to older buildings with outdated designs or less robust construction.

Building Material Impact on Premiums

The inherent durability and resistance to various hazards of different building materials directly influence insurance costs. Concrete buildings, known for their strength and fire resistance, typically attract lower premiums than those constructed using wood or other less durable materials. This is because concrete structures are less susceptible to damage from fire, strong winds, and seismic activity, reducing the insurer’s potential payout in case of a claim.

Conversely, wooden structures, while aesthetically pleasing, are more vulnerable to fire damage and termite infestation, resulting in higher premiums to compensate for the increased risk. The use of modern, fire-retardant treated wood can mitigate this risk somewhat, but premiums will still likely be higher than for comparable concrete structures.

Impact of Building Age and Condition

A building’s age and overall condition are significant factors in determining insurance premiums. Older buildings, especially those lacking regular maintenance, are more prone to wear and tear, increasing the likelihood of damage and the associated repair costs. Factors such as outdated electrical wiring, plumbing systems, and roofing materials all contribute to a higher risk profile and thus higher premiums.

Regular maintenance and upgrades can help mitigate these risks, potentially leading to lower premiums. For instance, a well-maintained 20-year-old villa with updated electrical systems and a recently replaced roof might receive a more favorable premium than a neglected 10-year-old apartment building with visible signs of deterioration.

Illustrative Examples of Premium Variations

Consider two villas of similar size and location in Dubai. Villa A is a newly constructed concrete structure with modern fire safety features, while Villa B is an older villa primarily constructed from wood with some signs of structural wear and tear. Villa A will likely receive a significantly lower premium than Villa B, reflecting the lower risk associated with its construction materials and overall condition.

Similarly, a modern high-rise apartment building in Abu Dhabi built using reinforced concrete and adhering to stringent building codes will likely have a lower premium than an older, less robust building in the same area. The difference in premiums can be substantial, potentially amounting to hundreds or even thousands of dirhams annually.

Understanding Policy Exclusions and Limitations: Home Insurance Premiums In United Arab Emirates

Home insurance in the UAE, while offering valuable protection, isn’t a blanket guarantee against all potential losses. Understanding the exclusions and limitations within your policy is crucial to avoid unexpected financial burdens. Knowing what isn’t covered can be just as important as knowing what is. This section clarifies common exclusions and their implications.It’s vital to carefully review your policy documents to fully grasp the extent of your coverage.

Many exclusions are standard across various providers, but specific details might vary. Understanding these limitations allows you to make informed decisions about additional coverage or risk mitigation strategies. Failure to understand these exclusions could lead to significant out-of-pocket expenses in the event of a claim.

Common Exclusions in UAE Home Insurance Policies

Several factors influence what’s excluded from standard home insurance policies in the UAE. These exclusions are designed to manage risk and prevent fraudulent claims. While the specifics may differ slightly between insurers, many common exclusions exist.

- Damage caused by wear and tear: Normal deterioration of your property over time, such as fading paint or cracked tiles, isn’t covered. This is because it’s considered a predictable and gradual process rather than a sudden event. The rationale is to focus coverage on unexpected and significant damage.

- Damage caused by neglect or lack of maintenance: If damage results from your failure to maintain your property, such as leaking pipes due to lack of inspection, the claim might be rejected. Insurers expect homeowners to take reasonable steps to prevent damage. This encourages responsible homeownership and reduces preventable claims.

- Intentional acts: Damage caused deliberately by the policyholder or someone residing in the property is excluded. This is a fundamental principle of insurance; it’s designed to prevent individuals from profiting from their own actions.

- Gradual damage (e.g., termite infestation): Damage caused by gradual processes like termite infestation might not be fully covered unless specific add-on coverages are purchased. This is because the damage often develops over an extended period, allowing for preventative measures.

- Flood damage (unless specifically included): Flood damage is frequently excluded unless you purchase a specific flood insurance add-on. Floods are often catastrophic events, and the risk is typically managed separately due to its high potential cost.

- Earthquake damage (unless specifically included): Similar to flood damage, earthquake damage often requires a separate policy add-on due to the significant and widespread nature of the risk. The cost of covering earthquake damage is substantial, and it’s often treated as a separate risk category.

The Impact of Natural Disasters on Home Insurance Premiums

Source: investopedia.com

The UAE, while generally a low-risk area for major natural disasters compared to other parts of the world, still faces certain weather-related events that can significantly impact property. Sandstorms, flash floods, and extreme heat can all cause damage to homes, leading to insurance claims and influencing premium costs. The level of risk, and therefore the cost of insurance, varies considerably across different regions of the country.Insurers carefully analyze historical weather data, geographical location, and the vulnerability of specific building types to assess the risk of natural disaster damage.

This detailed risk assessment is a key component of their pricing models. Factors such as proximity to water bodies, the type of building materials used, and the overall condition of the property all contribute to the final premium calculation. Areas with a higher historical frequency of sandstorms or flash floods, for example, will typically have higher premiums than those in less vulnerable locations.

The use of sophisticated actuarial models allows insurers to accurately reflect these regional variations in risk.

Regional Variations in Natural Disaster Risk and Premiums

The risk of sandstorms is relatively high across the UAE, particularly in the interior regions and during certain times of the year. Coastal areas, however, face a greater risk of flooding, especially during periods of heavy rainfall. Northern Emirates, with their mountainous terrain, may be more susceptible to flash floods compared to the flatter areas of the central and southern emirates.

Consequently, home insurance premiums tend to be higher in areas with a greater historical incidence of these events. For example, premiums in areas prone to flash flooding might be significantly higher than in areas with a lower risk profile, reflecting the increased likelihood of claims.

Insurer Risk Assessment and Pricing Models

Insurers employ a multi-faceted approach to assessing and incorporating natural disaster risks into their pricing models. This involves detailed analysis of historical weather data, geographical information systems (GIS) mapping to identify high-risk zones, and sophisticated statistical modeling techniques. They also consider factors such as the age and construction quality of buildings, as older or poorly constructed buildings are more vulnerable to damage.

The type of building materials plays a significant role; for example, homes constructed with materials more resistant to sand damage might attract lower premiums. Furthermore, insurers may use satellite imagery and other advanced technologies to assess the vulnerability of individual properties. These assessments allow them to create a finely tuned pricing structure that accurately reflects the risk associated with each property.

Mitigating Natural Disaster Risks to Lower Premiums

Homeowners can take proactive steps to mitigate the risk of damage from natural disasters and potentially lower their insurance premiums. These measures include installing flood barriers or elevating electrical equipment in flood-prone areas. Regular maintenance and upgrading of the home’s structure, such as reinforcing roofs or walls to withstand strong winds, can significantly reduce the likelihood of damage from sandstorms.

Choosing building materials that are resistant to the specific natural hazards prevalent in the area can also lead to lower premiums. Some insurers may offer discounts to homeowners who demonstrate a commitment to risk mitigation through the implementation of such preventative measures. For example, an insurer might offer a discount to a homeowner who installs a sophisticated drainage system to reduce the risk of water damage.

Documentation of these preventative measures can be crucial in securing these discounts.

Tips for Obtaining Affordable Home Insurance in the UAE

Securing affordable home insurance in the UAE requires a proactive approach and a thorough understanding of the market. By employing smart strategies and carefully comparing policies, you can significantly reduce your premiums without compromising essential coverage. This section provides practical advice and actionable steps to help you achieve this goal.Negotiating Lower Premiums with Insurance Providers involves several effective strategies.

Direct communication is key; don’t hesitate to discuss your needs and explore potential discounts.

Negotiating Lower Premiums

Several strategies can help you negotiate lower premiums. Firstly, shop around and obtain quotes from multiple insurers. This allows you to compare prices and coverage. Secondly, consider bundling your home insurance with other policies, such as car insurance, from the same provider. Many insurers offer discounts for bundled policies.

Thirdly, maintain a good claims history. A clean record demonstrates responsible homeownership and can lead to lower premiums. Finally, be prepared to negotiate. Don’t be afraid to politely discuss your budget and inquire about any potential discounts or promotions. For example, if you’ve been a loyal customer for several years, you might be eligible for a loyalty discount.

Similarly, making a larger upfront payment might reduce your overall premium cost.

Comparing Home Insurance Policies

A step-by-step guide for comparing policies and making informed decisions is crucial for securing affordable coverage.

- Gather Quotes: Obtain at least three quotes from different insurance providers. Ensure that the quotes are based on similar coverage levels to enable fair comparison.

- Analyze Coverage: Carefully review each policy’s coverage details, paying close attention to what is included and excluded. Note any differences in coverage limits and deductibles.

- Compare Premiums: Compare the total annual premiums, factoring in any discounts or additional costs. Consider the value you receive for the price, not just the lowest premium.

- Assess the Insurer’s Reputation: Research the financial stability and customer service ratings of each insurer. Look for reviews and testimonials online to gauge their reputation and responsiveness.

- Read the Fine Print: Before signing any policy, thoroughly read the policy document to understand all terms, conditions, exclusions, and limitations.

- Choose the Best Fit: Based on your analysis, select the policy that best balances cost, coverage, and insurer reputation.

Improving Your Home’s Security

Implementing home security measures can significantly impact your insurance premiums. Many insurers offer discounts for homes equipped with security systems, such as alarms, fire detectors, and security cameras. Investing in these measures not only enhances your home’s safety but also reduces your insurance costs. For instance, installing a monitored alarm system could result in a 10-15% reduction in your premium.

Similarly, fire-resistant building materials can lead to lower premiums.

Maintaining a Good Claims History

Avoiding unnecessary claims is a key strategy for keeping premiums low. Filing frequent claims, even for minor incidents, can signal higher risk to insurers and result in premium increases. Instead, consider addressing minor repairs yourself, if feasible, to maintain a clean claims record. For example, repairing a small crack in your wall yourself rather than filing a claim can help you maintain a lower premium.

Summary

Securing affordable and comprehensive home insurance in the UAE requires careful consideration of various factors, from property characteristics and location to the specific coverage offered by different providers. By understanding the key influences on premium costs and employing effective comparison strategies, UAE residents can make informed decisions to protect their valuable assets. Remember to always carefully review policy details, including exclusions and limitations, to ensure the coverage aligns with your specific needs and budget.

Proactive risk mitigation, such as regular home maintenance, can also contribute to lower premiums in the long run.

Essential FAQs

What is the average home insurance premium in the UAE?

There’s no single average, as premiums vary widely based on factors like location, property value, and coverage level. It’s best to get quotes from multiple providers.

Can I insure my contents separately from the building structure?

Yes, many policies allow you to insure your building and contents separately, offering flexibility in coverage and cost.

What happens if I make changes to my property after purchasing insurance?

You should always inform your insurer about significant changes to your property, such as renovations or additions, as this can impact your coverage and premium.

How long does it take to get a claim approved?

Processing times vary depending on the insurer and the complexity of the claim. It’s advisable to check the insurer’s claims process beforehand.

What are the penalties for not having home insurance?

While not legally mandated everywhere in the UAE, lack of insurance can leave you financially vulnerable in case of damage or loss. Many mortgage lenders require it.